Capital One Auto Finance: Your Guide To Loans & Refinancing

Are you navigating the complex world of auto financing and seeking a financial partner that understands your needs? Capital One Auto Finance stands out as a beacon of accessibility, offering auto loans even to those with less-than-perfect credit, with a minimum credit score requirement of just 500. This article dives deep into the services, benefits, and considerations surrounding Capital One Auto Finance, providing a comprehensive guide for prospective borrowers.

The landscape of auto financing can be daunting, filled with jargon, fine print, and varying interest rates. Choosing the right lender is crucial, and Capital One aims to simplify the process. They provide a suite of tools and resources designed to empower borrowers, from pre-approval options to online account management. This article will explore how Capital One streamlines the borrowing experience, from initial application to loan management, helping you make informed decisions and take control of your financial future.

Capital One Auto Finance Overview

- Peter Maffays Ehewirrnis Scheidungen Amp Frauen Ein Berblick

- Mandarine Vs Clementine Der Unterschied Einfach Erklrt

With roots in providing accessible financial solutions, Capital One has evolved into a significant player in the auto loan market. They are committed to offering competitive rates, flexible terms, and a user-friendly experience. Whether you're looking to finance a new or used car, refinance an existing auto loan, or simply manage your current loan, Capital One provides the tools and support to navigate the process efficiently.

One of the primary advantages of Capital One Auto Finance is its accessibility. They cater to a broad spectrum of credit profiles, making them a viable option for individuals with both excellent and less-than-perfect credit histories. Their transparent approach to rates and terms, coupled with a focus on customer service, makes them an attractive choice for many borrowers.

Capital One offers a wide range of services to meet different needs. Potential borrowers can sign in to access all of your capital one accounts, view account balances, pay bills, transfer money, and more. Their services extend to helping you find out how to apply for a new or used car loan, refinance your existing auto loan, or manage your loan online. In addition, they offer the ability to apply for credit cards, checking and savings accounts, and access digital tools and financial wellness resources.

Capital One Auto Loan Details

Capital One's rates are competitive and transparent. Many card issuers, including Bank of America, Barclaycard, Capital One, Citi, Discover, PenFed, Truist, USAA, U.S. Bank, allow you to transfer an auto loan balance to a credit card. The bank really shines in its customer experience. The process is seamless from start to finish, and makes it easy to apply for and take out a loan. Unlike some auto lenders, Capital One offers refinancing with competitive rates. You can qualify for a Capital One auto loan with a credit score as low as 500.

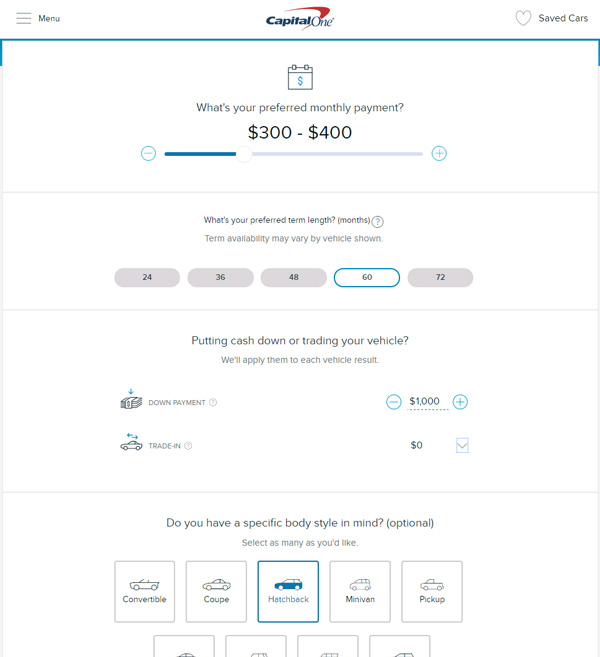

Moreover, Capital One facilitates a smooth application process. You can apply for pre-approval before you head to the car lot. Before you head to the car lot, get preapproved with Capital One. At the dealership, you can complete your final credit application at the dealership and drive home with your new car. Capital One offers auto loans with competitive rates and flexible terms. Find answers to common questions about auto financing with Capital One, such as how to pay your previous lender, transfer your title, and refinance your loan. Learn how to avoid errors and understand your credit report and loan documents.

Learn different ways to pay your capital one auto loan bill, such as online banking, phone, mail or in person. Capital One has several options that allow you to choose a payment method that is convenient for you. A convenient option to help avoid late payments, enrolling in autopay allows you to select your payment options for your capital one credit card account on a recurring basis. Many card issuers allow you to transfer an auto loan balance to a credit card, including Bank of America, Barclaycard, Capital One, Citi, Discover, PenFed, Truist, USAA, U.S. Bank.

A monthly payment calculator will typically estimate your car payment using simple interest. Since interest is determined by your remaining monthly balance, the more you can pay toward your auto loan per month, the less interest you will pay over time. With terms of 24 to 84 months, Capital One provides a fairly standard auto loan refinancing option.

Managing your auto loan payment requires consistent communication with your lender and careful budgeting. By familiarizing themselves with these key aspects, borrowers can navigate their loan repayment journey with confidence and financial responsibility. Learn about the new due date on your auto loan and making payments once you refinance. Complete your final credit application at the dealership and drive home with your new car. Find out the payment address, phone number, and disclosure information.

Here is a table on how to apply for an auto loan and how to manage a loan online with Capital One:

| Category | Details |

|---|---|

| Accessing Your Account | Sign in to your Capital One account to access all your accounts and manage your auto loan. |

| Pre-Approval | Before heading to the car lot, get pre-approved with Capital One. This can streamline the financing process. |

| Application Process | Apply for a new or used car loan online. You will need to provide information about the vehicle you want to finance and your personal and financial details. |

| Loan Management Tools | Use the online portal to view account balances, pay bills, and transfer money. |

| Refinancing | Explore the option of refinancing your existing auto loan with Capital One to potentially secure a lower interest rate or more favorable terms. |

| Payment Methods | Learn different ways to pay your capital one auto loan bill, such as online banking, phone, mail or in person. |

| Customer Support | Find answers to common questions about auto financing with Capital One, such as how to pay your previous lender, transfer your title, and refinance your loan. |

| Resources and Financial Wellness | Access digital tools and financial wellness resources. |

| Due Date and Fees | Managing auto loan payments with Capital One Auto Finance requires a comprehensive understanding of the payment due date, late fee policy, and proactive strategies to avoid incurring additional fees. |

Refinancing Your Auto Loan with Capital One

Capital One Auto Finance only refinances loans from other financial institutions, not including Capital One subsidiaries.Your current lender needs to meet one of the following requirements:* If you need to pay off your loan with your current lender, your financial institution will need to provide the necessary information so that the loan can be transferred to the new lender. This process, called a payoff, settles the outstanding balance of your loan and the lender will release their interest in the asset.

Capital One provides a fairly standard auto loan refinancing option. With terms of 24 to 84 months. Unlike some auto lenders, Capital One offers refinancing with competitive rates.

Understanding the intricacies of auto loan refinancing is key. Capital One's refinancing options can potentially lower your interest rate, reduce your monthly payments, or change the terms of your loan. To proceed, you will need to provide details about your current loan, the vehicle, and your financial information.

Credit Score Considerations

A significant advantage of Capital One is its accessibility. They recognize that credit scores don't always reflect the full picture of a borrower's financial responsibility. With a required minimum credit score of just 500, Capital One is an option whether you have poor credit or excellent credit. Checking your credit score can help you gauge your loan approval chances. You can qualify for a Capital One auto loan with a credit score as low as 500. Last name social security number or itin no need for dashes, we'll format the number for you.

However, remember that interest rates are often tied to creditworthiness. While Capital One provides a pathway for borrowers with lower credit scores, the interest rates may be higher than those offered to individuals with excellent credit. By familiarizing themselves with these key aspects, borrowers can navigate their loan repayment journey with confidence and financial responsibility.

Paying Your Capital One Auto Loan

Capital One offers several convenient payment options. Capital One has several options that allow you to choose a payment method that is convenient for you. A convenient option to help avoid late payments, enrolling in autopay allows you to select your payment options for your Capital One credit card account on a recurring basis. You can set up recurring payments, which automatically deduct from your account. Learn different ways to pay your capital one auto loan bill, such as online banking, phone, mail, or in person. You can also pay by phone, mail a check, or visit a Capital One branch. Understanding payment due dates and the implications of late payments is crucial for maintaining good financial standing.

Mail a cashier's check, money order, or personal check, along with the payment coupon in your monthly statement to: Capital One Auto Finance, P.O. Box 60511, City of Industry, CA 91716. Managing your auto loan payment requires consistent communication with your lender and careful budgeting.

You will need to contact Capital One directly for payment information such as late fees or other options. Some facts about paying bills through recurring payments.

In general, a loan extension will allow you to skip a certain number of immediate paymentswhich, while not set in stone, is typically just oneand add them onto the back of the loan. In most cases, the maturity date of the loan is then extended by the number of postponed payments.

Capital Ones rates are competitive and transparent, but where the bank really shines is in its customer experience. The process is seamless from start to finish, and makes it easy to apply for and take out a loan.

Capital One Auto Finance Reviews

While customer reviews for Capital One Auto Finance are mixed, it's crucial to consider both positive and negative experiences. Many customers have expressed satisfaction with the ease of the application process, competitive rates, and the overall customer service experience.

Every time I use [Capital One], I have a good experience.

45+ auto loan products reviewed and rated by our team of experts. 30+ years of combined experience covering financial topics. Objective, comprehensive star rating system assessing 4 categories and

Below are some Capital One Auto Finance reviews that we found during our research. While Capital One auto finance reviews from customers are mixed, we found plenty of upbeat reviews. Here are two that we considered worth sharing:

If you're considering Capital One Auto Finance, take the time to research and compare offers, read reviews, and understand the terms and conditions. Finding the right auto loan is essential to ensure a smooth and financially sound vehicle purchase or refinance.

The information contained in this message is reflective of Capital Ones founder and CEO's letter to associates. To read the full letter, click here.

While business activity has slowed, Capital One has continued to support consumer and business clients who rely on our products and services to live their lives, support their families, or make payroll.

Common questions capital one auto finance, 7933 preston road, plano, tx

Detail Author:

- Name : Lane Beatty

- Username : vjerde

- Email : borer.gudrun@gmail.com

- Birthdate : 1995-08-27

- Address : 54835 Pietro Loaf Suite 270 Port Louisabury, CT 50613-8979

- Phone : 817-221-0623

- Company : Corkery-Swaniawski

- Job : Diesel Engine Specialist

- Bio : Hic explicabo praesentium ipsam nam. Non neque unde voluptatum expedita voluptas aut. Recusandae non dolorem nihil saepe et dolorem similique. Minus veniam unde cumque non ullam.

Socials

instagram:

- url : https://instagram.com/veum1991

- username : veum1991

- bio : Ut ducimus est dolor. Eos repellat autem qui voluptatum. Et quidem magni et assumenda rem rerum.

- followers : 2062

- following : 2628

linkedin:

- url : https://linkedin.com/in/ervinveum

- username : ervinveum

- bio : Fugit ratione aut velit rerum.

- followers : 6303

- following : 675

tiktok:

- url : https://tiktok.com/@ervin.veum

- username : ervin.veum

- bio : Et libero ipsa velit nobis eum. Id non eum delectus qui sed dolores.

- followers : 2809

- following : 100

facebook:

- url : https://facebook.com/ervin_dev

- username : ervin_dev

- bio : Ducimus sapiente consequuntur odit nulla quibusdam.

- followers : 6098

- following : 1275